In the fast-evolving world of digital finance, Moniepoint Login has become a gateway to financial empowerment for millions of Nigerians. Moniepoint, launched in 2019 by the then-TeamApt Inc. (now Moniepoint Inc.), has redefined agency banking and business-focused digital financial services across the country. Whether you’re a customer, a merchant, or a potential Moniepoint Agent, this guide will walk you through everything you need to know about Moniepoint Login—from setting up your account to managing your POS services and accessing financial tools like loans, expense cards, and more.

Understanding Moniepoint: Nigeria’s Digital Finance Powerhouse

So before I bore down into the details on how to go about the Moniepoint Login process, it will be imperative to get some articulation concerning the origin as well as the growth of this pioneer fintech platform.

What is Moniepoint?

Moniepoint is a fintech that in Nigeria provides an end-to-end digital business with payment solutions as well as banking. The tools offered by it since the time of its launch initially in improving the agency banking infrastructure include mobile banking, POS terminals, ATM withdrawals, and merchant loans.

Is Moniepoint a bank?

Yes, since 2022, Moniepoint has been the fully licensed Microfinance Bank in regulation of the Central Bank of Nigeria (CBN). It implies that Moniepoint Login and other services now allow you to access controlled banking services like savings accounts, transfers, expense cards, and loans.

Who is the owner of Moniepoint?

Moniepoint is owned and run by Moniepoint Inc., formerly known as TeamApt Inc. It was established by Nigerian fintech experts whose foundations were laid in one of the first Nigerian digital payment platforms, Interswitch. Currently the firm has spread to several nations and has more than 1000 professionals.

Moniepoint Login: Step-by-Step Guide

Where to Login

You can log into your Moniepoint account in two primary ways:

- Via the Moniepoint web portal: https://atm.moniepoint.com

- Via the Moniepoint Mobile App, available on Android and iOS.

Moniepoint Login Process

To successfully log in:

- Go to atm.moniepoint.com or open the Moniepoint app.

- Enter your registered phone number or email address.

- Input your secure password.

- Click on Login.

- If you’ve forgotten your password, select “Forgot Password” and follow the recovery steps.

Common Login Issues

If you’re locked out after multiple failed login attempts:

- Contact Moniepoint Customer Care via support@moniepoint.com.

- Use the “Help” feature on the app for immediate support.

Pro Tip: Always enable two-factor authentication (2FA) for your Moniepoint Login to boost account security.

Moniepoint Account Registration Process

Thinking of joining the Moniepoint network? Here’s how you can open your account:

How to Register on Moniepoint (Web or App)

- Visit the registration page at atm.moniepoint.com.

- Click Sign Up.

- Enter your name, phone number, email, and password.

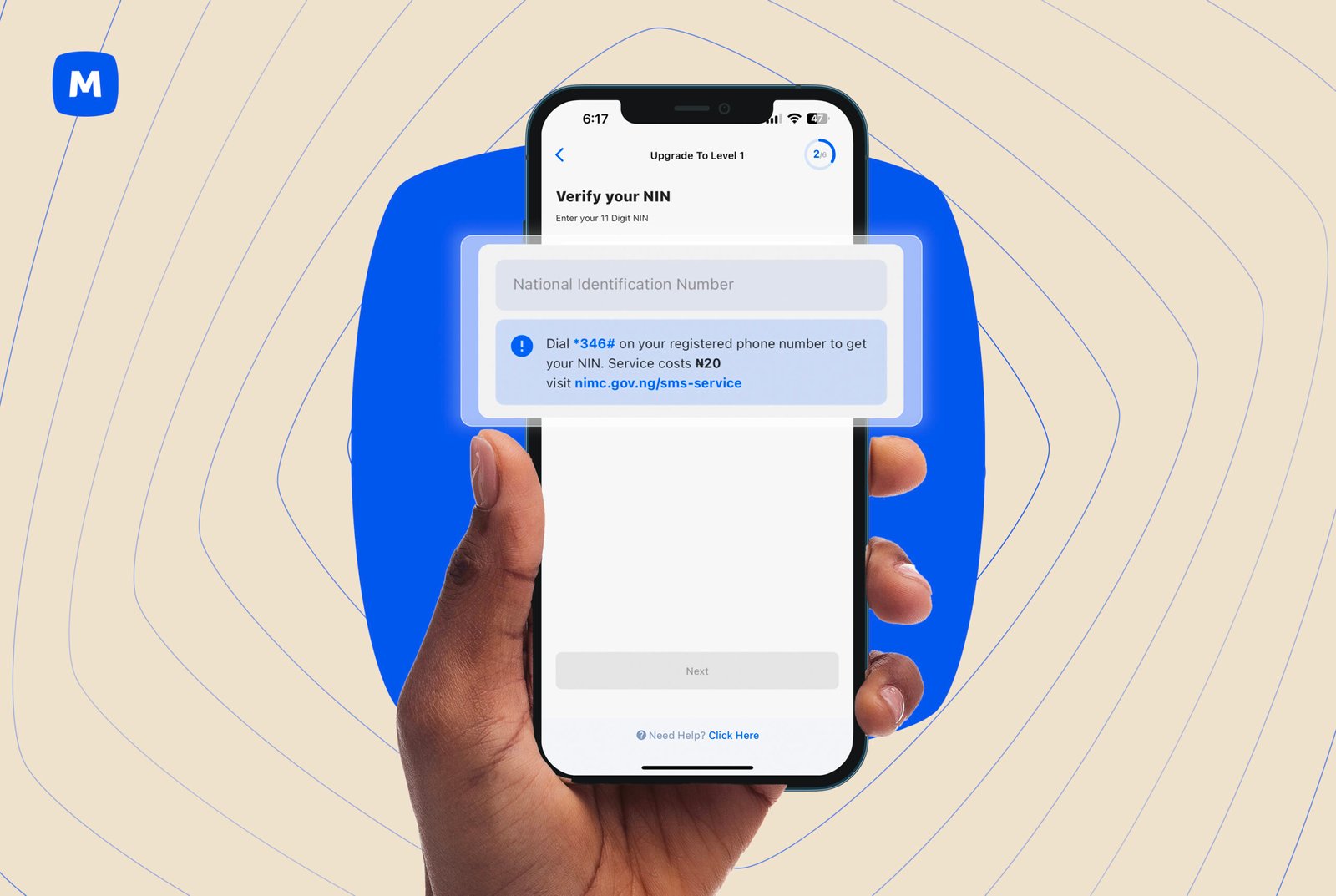

- Verify your identity using your BVN, NIN, and a valid ID (Driver’s License, Voter’s Card, etc.).

- Upload proof of address (utility bill).

- Choose your username and set your Moniepoint Login credentials.

- Submit for approval and complete KYC verification.

Moniepoint Account Access Requirements

| Requirement | Details |

| Valid Email | To receive verification and transaction notifications |

| Mobile Phone Number | Linked to your BVN for verification and alerts |

| BVN & NIN | Required for higher transaction limits and full banking access |

| Government ID | International Passport, Driver’s License, Voter’s Card, or NIN Slip |

| Proof of Address | Utility bill (electricity, water, internet) dated within the last 3 months |

Moniepoint Transaction Fees Overview

Moniepoint charges competitive fees to keep services accessible and efficient.

| Service Type | Fee Estimate (₦) |

| Transfer to Moniepoint | Free or very low |

| Transfer to Other Banks | ₦10 – ₦50 per transaction |

| Airtime/Data Purchase | No extra fee |

| Bill Payments | Nominal fee (₦10–₦100) depending on service |

| POS Terminal Usage | Varies by terminal type and volume |

What Moniepoint Login Dashboard can do Using Moniepoint App

After you have successfully undergone the process of Moniepoint login, whether via the application or the web portal, you are invited to an interactive and user-friendly dashboard that becomes the control room of your financial activities.

The Moniepoint dashboard targets people and business owners, as it provides real-time access to the balance, the history of transactions, and services in-store. With this, users get to smoothly make transfers, pay utility bills, purchase airtime or data, and even order Moniepoint POS terminals or seek loans.

Loans, Cards, and More: Services to which You Can Get Access After Login

By logging in to your Moniepoint account, you have access to a number of extra financial products on top of remittance transactions. Moniepoint Loans is also one of the main services, as it offers short-term loans with immediate access to credit, enabling users to borrow it. Once you are logged in, you just need to go through the Overdraft Loans tab to apply hence no paperwork and lengthy queues. Loans are given out very fast and, in most cases, within a few minutes directly into your Moniepoint wallet.

Moniepoint Expense Cards can also be applied by users to assist in managing and tracking the expenditures of the business. They are also present in their virtual and physical forms, and it is possible to make an order directly through the dashboard after logging in. It is possible to allocate them to employees, specify budgetary limits and monitor expenditures—all this in the application.

Using the Moniepoint Login to use POS Services

A strong POS network is one of the major services offered by Moniepoint and you can use all of the related facilities immediately after Moniepoint login. Regardless of whether you are a novice agent or an experienced merchant, the dashboard can be used to request a new POS machine, get delivery status and watch over the utilization of the device. The process of requesting POS is simple: log on, open the POS section, fill in the details about your business, choose the type of terminal (such as the MP35P Smart POS), and pay.

After you receive your POS terminal, you can see real-time transaction volumes on the dashboard, see the amount of commissions you earn, and obtain customer support. In case you have more than one terminal, you may put various terminals at the disposal of different employees and monitor individual performance.

The availability of POS services through the login process by Moniepoint does not only streamline the daily activity of the business, but it also provides analytical tools to assist agents in making strategic decisions

Conclusion

In a rapidly evolving digital economy, Moniepoint Login stands out as a powerful gateway to modern banking, agency services, and financial empowerment for individuals and businesses across Nigeria. Whether you’re logging in to send money, apply for a loan, manage a POS terminal, or request an expense card, Moniepoint delivers a seamless, secure, and intuitive user experience. Its all-in-one platform brings together core financial tools—from transfers and bill payments to mobile banking and merchant services—under one roof, accessible anytime through the web or mobile app.

Read More Blogs 🙂