Tools such as a compound monthly interest calculator often allow the user to see the effect of their savings. These tools specifically show how a regular savings routine with monthly compound interest may help to increase your available funds. In addition, a compound monthly interest calculator tends to allow the user to project future savings values by taking some basic information about the savings plans. This information may assist one in making proper financial decisions. The article discusses how to use a compound monthly calculator for planning out savings, the importance of compound interest, the formula for evaluating compound monthly interest, etc.

What is Compound Interest?

Before you understand how to use compound calculators, it is important to know what compound interest actually is. Compound interest is the interest earned on the initial deposit (the principal) and the interest earned over the duration of the period. The effect of interest on interest can exponentially support the potential growth of finances.

What is a Compound Monthly Interest Calculator?

A compound monthly calculator is an online tool that may help you estimate how much your savings will grow over time when interest is compounded every month. You may need to simply enter a few details, and the calculator shows you the future value of your savings and the total interest earned.

Key Features of a Compound Monthly Calculator

The following are some of the features of the compound monthly calculator:

- Inputting the Principal Amount: Enter the principal amount accurately; this forms the base for growth calculations.

- Selecting the Interest Rate: Provide the annual interest rate, which the calculator converts to monthly compounding to reflect true earnings.

- Choosing the Period: Specify the investment duration in years or months; longer periods enhance compounding effects.

- Understanding Compounding Frequency: Monthly compounding adds interest multiple times a year, accelerating growth compared to annual compounding.

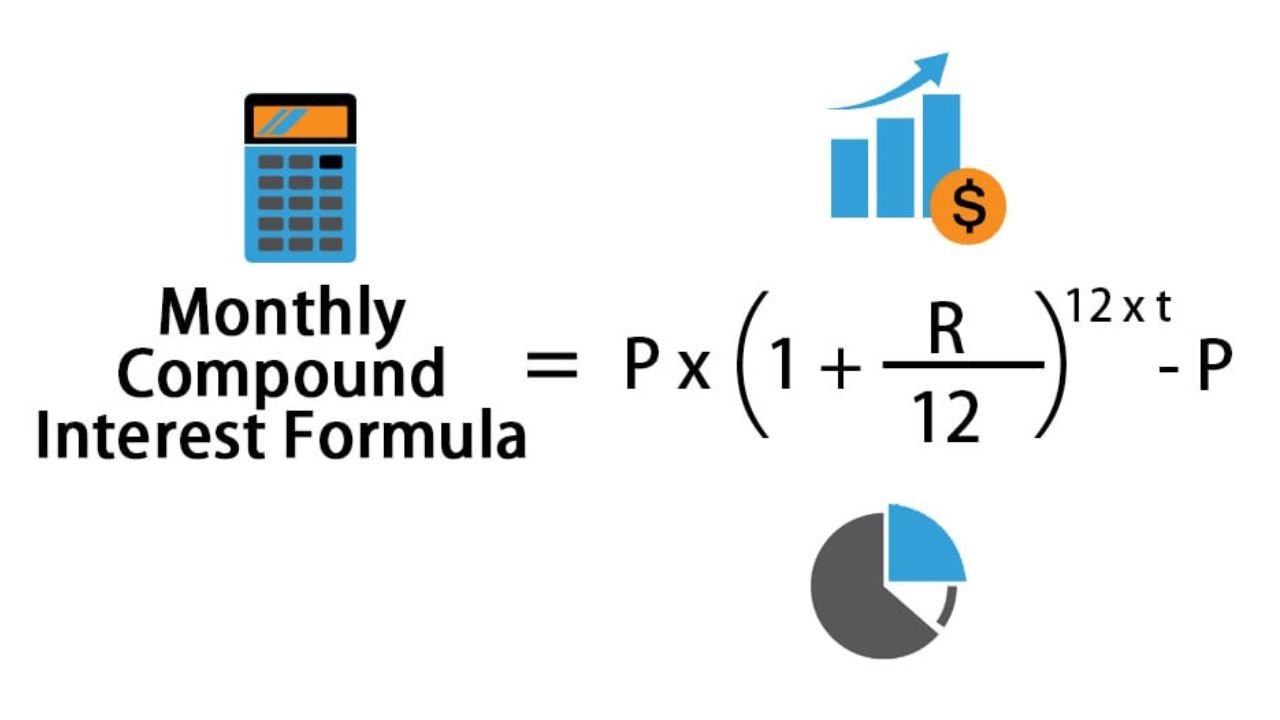

Formula for Calculating Compound Monthly Interest

Most compound monthly interest calculators use the following formula:

CI = P(1 + R/N)^(N×T)

Where:

- CI represents the final amount after compounding

- P stands for your initial principal (starting amount)

- R is the annual interest rate in decimal form

- N refers to compounding frequency per year (12 for monthly)

- T indicates the total time period in years

This formula calculates how your savings grow when interest compounds regularly over time.

Steps to Effectively Use a Compound Monthly Calculator

The following are some easy steps to calculate compound monthly interest online using the compound monthly calculator.

- Step 1: Find a reputable financial website offering a compound calculator with monthly options for accurate growth projections.

- Step 2: Enter your initial savings amount and current interest rate as requested by the calculator’s input fields.

- Step 3: Select the monthly compounding option, which calculates interest twelve times yearly to maximise your potential investment growth.

- Step 4: Choose your investment duration in months or years. In general, considering longer timeframes generally produces significantly suitable results.

- Step 5: Check all entries before clicking calculate. The compound monthly calculator shows the final amount and interest earned quickly.

Try different amounts, rates, or durations to compare results. For example, longer durations might raise returns. Combining the final output with the results of tools like a mutual fund calculator may help you get a detailed investment perspective. This may help you manage and align your finances to get positive results related to investment and savings.

Moreover, save or note results for later use. Some platforms often let users save results, helping track plans for goals like school or retirement.

Why Use a Compound Monthly Interest Calculator?

A compound monthly calculator often shows how savings grow with monthly interest. Unlike simple interest, which adds to the initial amount, compound interest includes earnings on the principal and added interest. This method might increase savings over time, useful for long-term plans in India.

Moreover, these tools save time and avoid mistakes. Manual calculations may lead to errors, but a compound monthly calculator gives fast, correct results. Seeing growth encourages steady saving, helping with goals like retirement or school fees, and simplifying financial planning.

Conclusion

A compound monthly calculator simplifies estimating savings growth, showing monthly compounding effects. By entering principal, rate, duration, and frequency, users get clear results. A mutual fund calculator adds value, showing mutual fund possibilities for goals like school or retirement. Both tools, on regulated platforms, ensure accuracy and promote steady saving. Steps like entering the principal and testing scenarios make them effective. Understanding and applying compound interest principles through these calculators contributes significantly to financial literacy and successful long-term planning. These calculators may help people plan wisely, using compounding to create a strong financial future with clarity.