The interest around the HAL Share Price has grown rapidly as more investors look toward defence and aerospace companies for long-term stability. This trend is not accidental. It reflects significant changes in government spending, manufacturing strength, and India’s push toward reducing defence imports. HAL remains one of the few companies capable of delivering complex aircraft and helicopter programs, which places it in a unique position within the market.

Investors have watched the HAL Share Price move through multiple phases over the last few years. The confidence in the market was also boosted because the company was getting new orders, better financial results, and increasing the production capacity. This created a good momentum and prompted institutional investors to be more exposed. The company’s long history, strategic importance, and expanding opportunities make its valuation a subject of constant discussion.

This detailed review explains what drives the movement of the HAL Share Price, how the business performs across segments, and what investors should understand while evaluating the company’s future potential.

Table of Contents

What Is HAL Share Price?

The HAL Share Price represents the market value of Hindustan Aeronautics Limited, a leading defence and aerospace manufacturer in India. It captures the perception of the investors on the performance of the company, its future revenue, and its future. This price is adjusted because of the financial performance, government purchases, company activity, and the market mood. Knowing this valuation assists the investors in making their wise decisions.

The strategic value of this stock is given the fact that HAL is a key contributor in the national defence. Its planes, helicopters, motors and avionics systems reinforce significant arms of the military. Such responsibility brings a level of long-term operational stability. Investors observe these patterns to understand whether the stock offers growth, safety, or both. The movement of the price often mirrors India’s defence expansion plans.

HAL Share Price Performance Over Recent Years

Investors often refer to historical movements to assess potential trends. The HAL Share Price has delivered exceptional returns over multi-year periods and has shown strong performance even during uncertain market cycles. This demonstrates that consistent defence demand supports long-term valuation. However, the price movement also highlights how sensitive the stock can be to new orders and policy announcements.

The company continues to attract interest due to its improving order book and the rising demand for indigenous aircraft and helicopters. This demand adds further depth to the stock’s long-term outlook. Although the price fluctuates like any other stock, the broader upward trend reflects confidence in the company’s capabilities. Investors often compare short-term volatility with longer cycles to understand the underlying position.

The table below highlights the recent performance trend.

HAL Share Price Movement:

| Period | Performance |

| 5-Year Price Change | +1696% |

| 52-Week High | ₹5,165.00 |

| 52-Week Low | ₹3,046.05 |

| Market Cap | ₹3,00,594 Cr |

This performance reinforces why the HAL Share Price has become a key focus among long-term investors.

HAL’s Business Segments and Their Impact on HAL Share Price

High performance within every business segment determines the valuation in the long term. HAL has many fields of operation, among them being aircraft, helicopters, power plants, avionics and aerospace structures. All the segments make their contributions depending on the demand cycles, government requirements, and exports. This diversity is beneficial to lower risk and stabilize revenue. Investors would like to have companies that are not dependent on a particular line of products.

Below is an overview of the company’s major operations.

HAL Business Segment Overview

| Segment | Key Products |

| Aircraft | LCA, Su-30 MKI, HTT-40, Dornier-228 |

| Helicopters | Dhruv, Rudra, LCH, LUH |

| Engines | Adour, AL-31FP, Garrett |

| Avionics | INS, HUD, Laser Range Equipment |

| Aerospace | Cryogenic Engines, Structures |

Such strong product diversity plays an important role in supporting the HAL Share Price at stable levels. The company manufactures fighter jets, transport aircraft, trainers, and advanced helicopters. These programs require long production cycles.

Therefore, revenue remains visible for years. This visibility supports consistent investor confidence. Additionally, international orders, even when small in number, enhance the company’s credibility in the global aerospace market.

HAL Share Price and the Influence of Government Orders

Government procurement decisions significantly influence the HAL Share Price, because defence projects extend over long periods and involve large budgets. When new aircraft or helicopter orders are announced, investors gain clarity about revenue expectations. Such clarity reduces uncertainty. Additionally, policy changes aimed at indigenisation also benefit HAL, as they reduce reliance on foreign manufacturers.

The approval of programs like LCA Mk1A, Light Combat Helicopter, and HTT-40 trainer aircraft created strong momentum in the market. These approvals signal multi-year production schedules. Investors respond positively because multi-year orders allow HAL to plan manufacturing and cost structures more effectively. This leads to predictable operating margins.

Such developments encourage institutional investors to increase exposure, which further supports the HAL Share Price. As the defence sector expands, HAL continues to benefit from the emphasis on domestic technology and reduced imports.

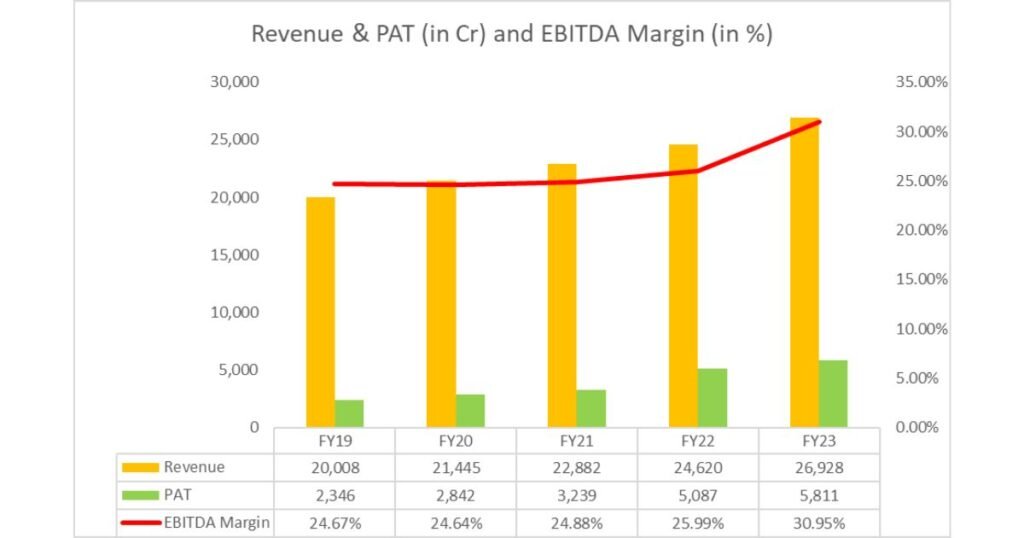

HAL Financial Performance and Its Effect on HAL Share Price

Strong financial performance supports investor trust. HAL’s revenue growth, profit margins, and zero-debt structure place it in a strong financial position. The company has consistently shown healthy quarterly results. These results reflect improved efficiency and increased production volumes. When financial indicators remain positive, the HAL Share Price tends to maintain upward momentum.

The company’s operating profits have also risen due to increased demand for aircraft upgrades, maintenance programs, and spare parts. These activities complement manufacturing revenue and add stability to earnings. The ability to grow without significant debt obligations further improves investor sentiment.

Recent Quarterly Financial Performance

| Quarter | Net Sales (₹ Cr) | Net Profit (₹ Cr) | EPS |

| Dec 2024 | 6,957 | 1,439 | 21.53 |

| Mar 2025 | 13,699 | 3,976 | 59.46 |

| Jun 2025 | 4,819 | 1,383 | 20.69 |

| Sep 2025 | 6,628 | 1,669 | 24.96 |

Such strong financial results provide consistent backing for the HAL Share Price.

Long-Term Outlook and Factors Supporting HAL Share Price

The long-term outlook remains positive due to the company’s expansion plans. HAL is increasing its production capacity for the LCA Mk1A and HTT-40. The development of new helicopter platforms adds further potential. These activities support future growth. The company is also working on UAV systems and civil MRO opportunities. These areas can become major contributors in the coming years.

In addition, HAL is strengthening its export presence. Although export levels are still developing, international interest in certain platforms continues to grow. This interest reflects confidence in the company’s engineering capabilities. Investors track such developments to assess potential valuation growth. Its Share Price benefits from long-term visibility that comes with these strategic plans.

Conclusion:

The HAL Share Price has become a strong area of interest among investors due to the company’s financial stability, large order book, and expanding role in India’s defence manufacturing ecosystem. This valuation reflects both past performance and future opportunity. The strategic plans of the company, the variety of products, and the favorable attitude by the governments places it in a great position to grow in the long run. The investors who are monitoring these developments can be in a better position to know how the stock can change with time.

Read Our More Blogs: BOM: 544150 Price Trends and Business Insights