Your selection of a broker stands as one critical decision for achieving financial achievement in forex trading. Your trading goals will find positive realization through an appropriate broker who shares your vision but you may experience setbacks from the wrong selection. Countless brokers look for your business yet you need to learn which factors guide your choice toward a broker who supports your trading ambitions. Selecting the premier forex broker requires studying essential factors explained in this article for making informed choices toward forex independence.

Understanding Your Trading Goals

Any exploration of forex brokers requires complete understanding of your trading objectives before proceeding. In your forex investment plan you must determine whether you want trading regular short-term opportunities or you need trading products that deliver long-term steady gains. Users need to choose between managing their investments by hand or letting trading systems take control of their assets. The process of goal definition acts as directional guidance to pick off the appropriate brokerage services.

Regulation and Security

ASIC- the Australian Securities and Investments Commission oversees the Australian forex market through strict oversight of transparent trading practices while setting regulations according to their standards. All forex trading brokers must receive ASIC regulation approval before you should choose them. ASIC regulation establishes an added security system for your funds through brokers who maintain their financial operations with integrity. ASIC regulation demands brokers to separate customer funds from their business operating accounts as a protection against fund misappropriation. Customers who choose brokers regulated by ASIC enjoy trading confidence because these brokers follow the strictest professional standards while being accountable to the government watchdog.

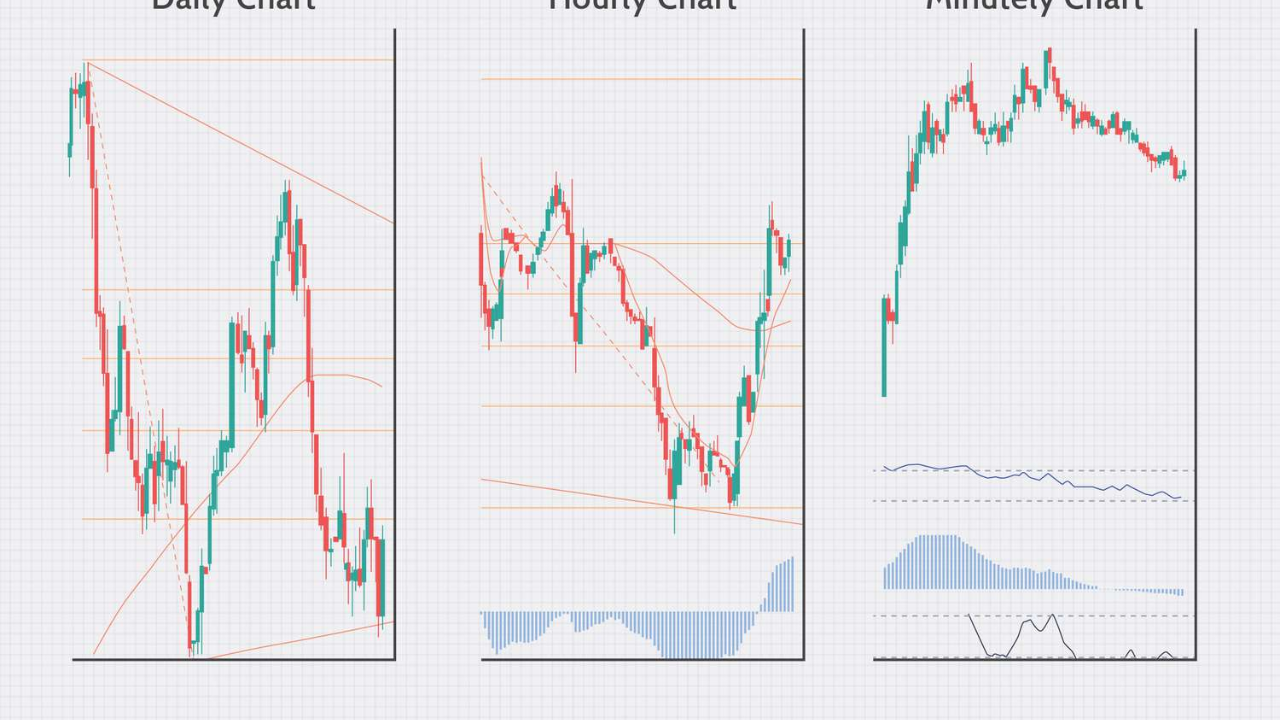

Trading Platform and Tools

Through their trading platform brokers allow you to buy and sell assets while performing analysis and account management. Trading experience becomes much better when you use a platform which provides friendly interface and extensive features. Choose sophisticated trading platforms offering sophisticated charting equipment together with live market data and automated order execution capabilities. Brokers give access to demo accounts which let users practice their platform through simulations before using their actual money.

Spreads and Fees

Your profits are directly affected by the currency pair buying and selling prices known as spreads together with all costs associated with your trading operations. The income that brokers earn primarily comes from spreads and commissions and traders need to know how brokers charge for their services. Participating brokers present spreads either as fixed numbers or as variables that expand during unpredictable market volatility. Analyze the spread costs along with fees which brokers charge to verify that their prices fit your trading approach and financial capacity.

Asset Diversity

In addition to dealing with currency pairs through forex trading brokers frequently provide trading opportunities in commodities and stocks and cryptocurrencies to their users. Your trading advantages increase when you have access to different assets within your portfolio particularly when you plan to expand your market positions or protect them. Review all available assets which brokers provide to find assets that match your trading portfolio.

Account Types

In order to serve different trading requirements brokers establish diverse account options. Different types of accounts exist at forex trading platforms starting from entry-level accounts dedicated to new traders while premium accounts are created for seasoned traders with big investment funds. Determine the appropriate trading account based on your experience level together with your tolerance for risk and investment value. Brokers generally provide Islamic accounts which abide by Sharia religious rules for traders who need them.

Freedom-seeking traders must carefully select their best forex broker because this choice directly impacts their trading performance. The selection process for an ideal forex broker requires you to define your trading objectives and to methodically examine regulatory standards along with trading systems and costs and leverage ranges and tradeable assets and customer assistance features and educational materials. These components enable you to determine the broker that meets your investment requirements. A broker at your side assumes roles beyond service provider since they will remain your trading partner for extended periods. Your search should lead you to choose a broker who provides the tools for you to reach your forex trading objectives as you progress toward economic freedom.