The intricacies of customs clearance serve as a pivotal juncture in the complex world of international trade. It’s a carefully choreographed dance that harmonizes legal, financial, and administrative aspects to facilitate the movement of goods across borders. This intricate ballet not only collects taxes, duties, and various fees but also ensures compliance with health, safety, environmental, and local regulatory requirements. Understanding this enigmatic process is essential for the smooth and efficient flow of imported goods to their intended destinations.

Embarking on the Customs Clearance Journey

The customs clearance journey unfolds like an elaborate ballet, a finely tuned performance that grants official approval to goods destined for foreign shores or transoceanic voyages. It’s a labyrinthine odyssey of paperwork, where meticulous attention to detail is paramount. This process entangles all involved in a web of regulations and the obligation to settle financial obligations in the form of taxes and duties. The custom clearance process is the gatekeeper of international trade, ensuring the seamless passage of legitimate products across geopolitical boundaries.

The overture to this customs clearance saga begins with importers or exporters presenting a treasure trove of documents. Invoices, packing lists, certificates of origin, and various supporting documents must be meticulously prepared, akin to a watchmaker’s precision, to avoid delays at the customs checkpoint. These documents undergo rigorous scrutiny by customs officials, who possess the authority to approve or reject them based on compliance with national regulations.

However, the journey may not end there. The customs clearance tapestry may demand additional prerequisites. Permits, licenses, and other specialized documents may be required for certain goods. These documents act as sentinels, guarding against unauthorized commodities, upholding capricious regulations, and ensuring that only compliant products gain entry.

The Multifaceted Nature of Customs Clearance

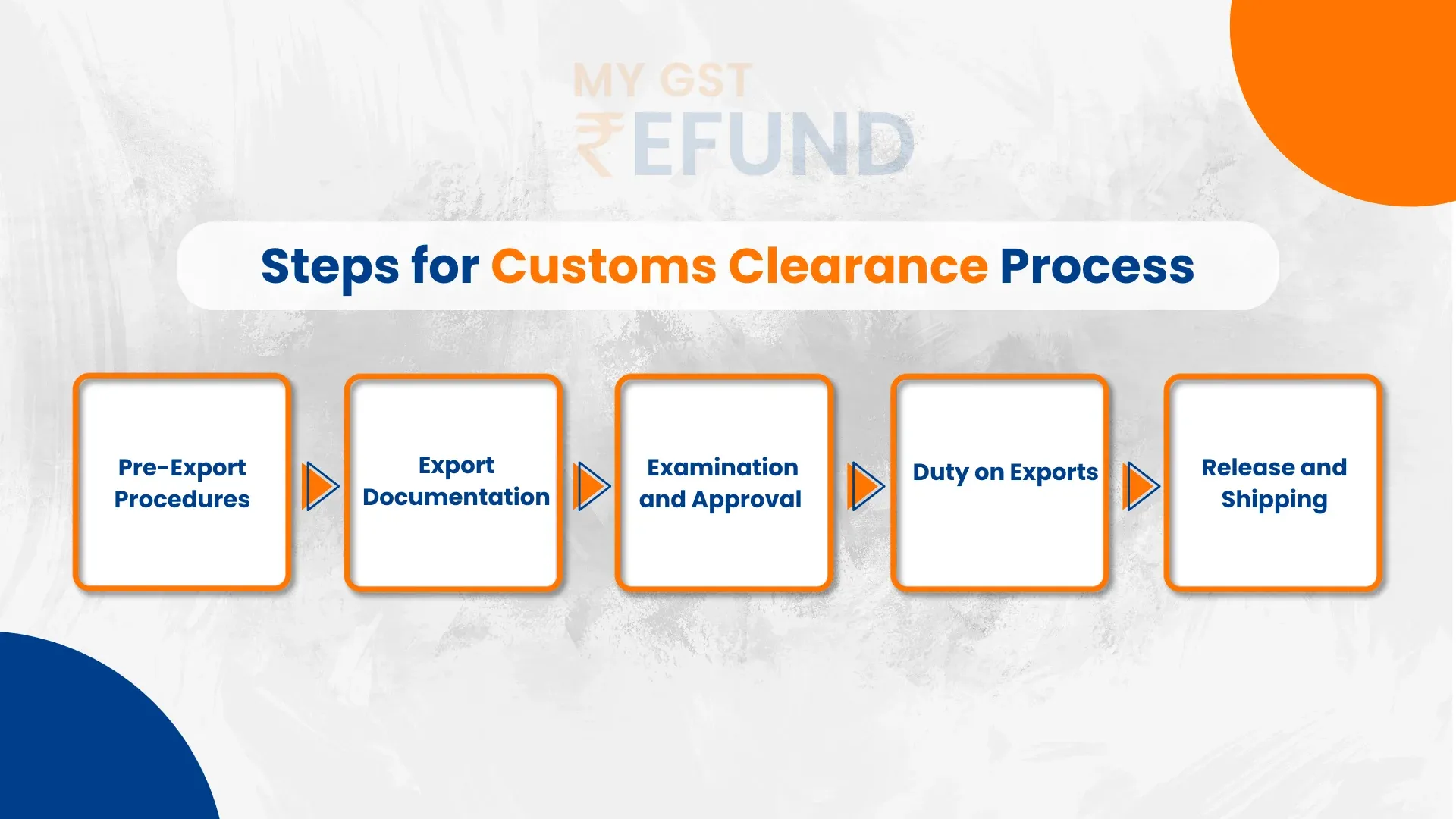

Customs clearance is a multifaceted dance, with each step representing a distinct act in the grand opera of international trade. This narrative acts as a guide, leading us through the convoluted steps: preclearance preparation, acquiring necessary documents and permissions, and presenting them to the customs authorities.

Preparing for Preclearance

The customs clearance process begins with preclearance preparation, where documents play a starring role. Commercial invoices, packing lists, bills of lading, certificates of origin, free trade agreements (FTAs), and export declarations all vie for attention. These documents, akin to actors on a stage, must be meticulously prepared to prevent delays and errors.

The Quest for Documents and Permissions

After navigating the preclearance stage, travellers must embark on a quest to secure the required documents and permissions from the host country’s government. These documents, permits, and licenses act as keys to unlock customs gates. They weave the intricate tapestry of compliance, ensuring that goods bear the mark of meticulous adherence to regulations.

The Benefits of Professional Assistance in Customs Clearances

Navigating customs clearance can be a daunting task for the uninitiated. The labyrinthine paperwork and complex procedures can confound even the most knowledgeable. Professional assistance offers a lifeline, providing several advantages:

Expert Guidance: Professionals possess extensive knowledge of the laws and regulations governing customs clearance. They guide clients through the intricate paperwork and documentation, ensuring successful navigation.

Time Efficiency: Professional assistance expedites the process by identifying potential pitfalls and addressing them promptly. This prevents delays and streamlines the customs clearance process.

Conclusion

The customs clearance process is a complex masterpiece, interwoven with understanding, regulations, and meticulous procedures. It may be time-consuming and labour-intensive, but it is crucial for the smooth functioning of international trade. As businesses navigate this treacherous path, knowledge serves as a guiding light, helping them navigate customs’ unpredictable terrain and avoid the pitfalls of fines and delays.