In the current fast-changing financial environment, the measures of success are efficiency, accuracy, and speed. We are living in a time where the customer desires hassle free digital experiences, particularly with the provision of credit. One way that ICICI Bank has acted on this requirement is by providing a strong digital lending platform that facilitates loan issuance without compromising on compliance and security. This system is an indicator of strategic change towards automation, transparency, and customer centric banking.

We are centered on the ways this platform helps to make loans processes easier, less operational, and more trustful between financial institutions and borrowers. This system has established itself as a fundamental component of retail lending business by matching technology with the practical banking requirements.

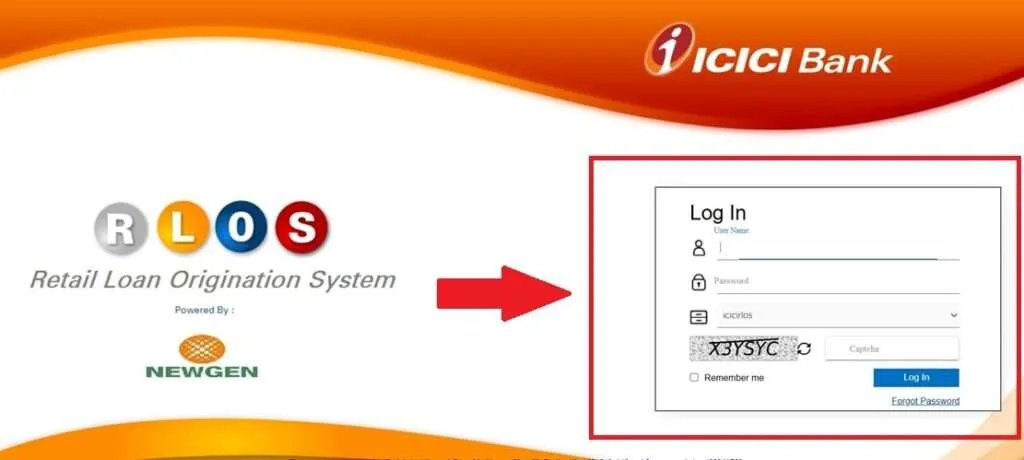

RLOS ICICI and Its Role in Retail Lending

The Retail Lending Origination System is developed to process the entire loan cycle in the digital form. We witness a well-organized process through which applications, verification of documents, credit assessment, acceptance and disbursement are processed in a single environment. This does away with fragmentation and makes all the loan products consistent.

The platform enables several types of retail loans such as personal loans, home loans, auto loans and business financing. Due to the flexibility of workflows, flexibility is retained by the banks without compromising the standardized way of processing. The equilibrium enhances turnaround time as well as accuracy of operations without interfering with the regulatory alignment.

Features of RLOS ICICI That Drive Efficiency

Lending efficiency is based on the performance of systems in communication and execution. This platform brings automation at the critical steps involved in loan processing. Application data is directly entered into verification modules and less time is required to enter data manually and errors are minimized.

The document management is also centralized so that applicants and internal teams can see the progress on a real-time basis. Credit assessment tools are built-in and assess the eligibility within a short period, a factor that enhances the speed of decision-making. Notifications maintain a sense of transparency so that the applicants are notified, eliminating follow-ups.

Security measures are used to guard sensitive fiscal information and control measures are used to confirm compliance with regulations. All these features enhance reliability and trust in the process of lending.

How RLOS ICICI Improves Customer Experience

Complexity is eliminated, and this enhances customer experience. We can see how the borrowers can have intuitive interfaces that direct them through the process. Applications are placed online, files uploaded electronically and status updates are also visible during the process.

Effective communication eliminates ambiguity. The applicants get to know of the timeframes, conditions, and results without multiple returns. Rapid approvals satisfy urgent financial requirements and the workflows are structured to avoid unproductive delays.

The platform makes accessing banking services easier, which increases its compatibility with current digital demands and improves the overall level of satisfaction.

Operational Benefits of RLOS ICICI for Banks

Banks gain a lot in terms of less processing time and low costs of operation. The automation eliminates manual repetitive work to allow employees to work on value-based work. Workflow visibility will enable the managers to detect bottlenecks in time and streamline resources.

There is enhanced risk control by incorporating integrated credit scoring and policy checks. Information underpins all the decisions and ensures the quality of portfolios and decreases the exposure to default. Scalability is used to make sure that an increase in loan volumes does not affect performance.

All these benefits contribute to the sustainable development and operational stability.

Process Flow Overview

| Stage | Digital Execution |

| Application | Online submission with guided inputs |

| Documentation | Secure digital upload and tracking |

| Credit Review | Automated scoring and validation |

| Approval | Policy-driven decision flow |

| Disbursal | Fast and secure fund transfer |

This structured flow ensures consistency, speed, and accuracy across lending operations.

Technology and Compliance Alignment

The contemporary banking system has to keep pace with the new regulatory changes. The platform has programmable compliance rules, and the updates undertaken do not disrupt operations. Audit trails are not removed making reporting and oversight easier.

The access controls and encryption of data ensure the safety of customer data. Such safeguards ensure a level of confidence in the safety of digital risks among the users and regulators as well.

Data-Driven Decision Making

Analytics tools will give information on the approval rates, processing time and the customer behaviour. We leverage these lessons to develop better loan products, enhance eligibility, and maximize the customer outreach strategies.

Based on data, decisions become less uncertain and planning in the long term. This analytical ability makes lending a responsive processing rather than a strategic growth management.

Scalability and Future Readiness

The systems have to scale as the digital lending begins to demand more. The platform enables growth in both regions and products without any variation in performance. Without reconstruction of main infrastructure, new workflows and integrations are added.

This preparedness is a guarantee of flexibility in a competitive financial landscape where innovation is the key to leadership.

Conclusion

RLOS ICICI is a giant leap towards complete customer centric lending with full digitalization. It transforms the origin and management of loans by automating, bringing transparency, and compliance. We understand its contribution to efficiency and customer trust and financial inclusion. Such platforms become the standard of the contemporary banking operations as the digital transformation progresses.

Also Read About :- Zoeymaywoods Identity